- Strategy: Creating and

Sustaining - Thinking Strategically

- Understanding the Concept of

Strategy - Setting the Right Financial

Goals - Economic Performance versus Shareholder

Value - Multiple Levels of Strategy

Drive - Economic Foundations of

Competition - Strategic Positioning

- Strategic Positioning

- Competing Regionally and

Globally - The

Role of Business in Society: Creating Shared

Value

Strategy:

Creating and Sustaining

Competitive Advantage

Professor Michael E. Porter

Harvard Business School

Guayaquil, Ecuador

October 25, 2011

This presentation draws on ideas from

Professor Porter"s books and articles, in particular,

Competitive Strategy (The Free Press, 1980);

Competitive Advantage (The Free Press, 1985); "What is

Strategy?" (Harvard Business Review, Nov/Dec 1996); and

On Competition (Harvard Business Review, 2008). No part

of this publication may be reproduced, stored in a retrieval

system, or transmitted in any form or by any

means—electronic, mechanical, photocopying, recording, or

otherwise—without the permission of Michael E. Porter.

Additional information

may be found at the website of the

Institute for Strategy and Competitiveness, www.isc.hbs.edu.

20111024 – Ecuador Strategy Presentation –

v3 – October 21, 2011 – Prepared by RA Jem Hudson

Thinking

Strategically

COMPETING TO BE -> THE BEST COMPETING TO

BE UNIQUE

The worst error in strategy is to compete

with rivals on the same dimensions

Understanding the

Concept of Strategy

• Strategy is different than

aspirations

– "Our strategy is to be #1 or

#2…"

– "Our strategy is to be the world

leader…"

– "Our strategy is to

grow…"

– "Our strategy is to provide superior

returns to our shareholders…"

• Strategy is more than a

particular action

– "Our strategy is to

merge…"

– "…

internationalize…"

– "… consolidate the

industry…"

– "…

outsource…"

– "…double our R&D

budget…"

• Strategy is not the same as

vision

– "Our strategy is to provide superior

products and services…"

– "…to advance technology for

mankind…"

Strategy defines the company"s

distinctive approach to competing and the competitive

advantages on which it will be based

Setting the Right

Financial Goals

• Strategic thinking starts with

setting proper financial goals for the Company

• The fundamental goal of a company is

superior long-term return on investment

• Growth is good only if

superiority in ROIC is achieved and sustained

– ROIC threshold

• Setting unrealistic

profitability or growth targets can

undermine

Strategy

Economic

Performance versus Shareholder Value

Economic Performance ? Shareholder

Value

Economic Performance

Sustained ROIC

Sustainable Revenue Growth

Shareholder Value

Stock Price

EPS Growth

EPS Multiple

?

Shareholder value is the result

of creating real economic valuePleasing today"s shareholders is

not the goal

Multiple Levels

of Strategy Drive

Competitive Advantage

Competitive or Business

Strategy

How to compete in each distinct

business or

Industry

?

Corporate or Portfolio

Strategy

The company"s mix of

businessesThe integration of business unit

strategies

Economic

Foundations of Competition

Competition occurs at the level of each

distinct business or industryCompany economic performance results

from two distinct causes

Industry Structure ? Positioning Within the

Industry

– Industry Attractiveness – Sustainable

Competitive Advantage

?

• Strategic thinking must encompass

both areas

• Companies must focus on the health

of the industry, not just their own position

Disaggregating Economic

Performance:

Industry vs. Position

Note: "Invested capital less excess cash"

is the average of the beginning period and the ending period

values. Excess cash is calculated by subtracting cash in excess

of 10% of annual revenue.

Source: Compustat (2007), author"s

analysis

…………..

…………..

Industry Average

9. Profitability of Selected U.S.

Industries

1998 – 2008

Note: ROIC calculated as EBIT divided by

Invested Capital

Source: Compustat , author"s

calculations

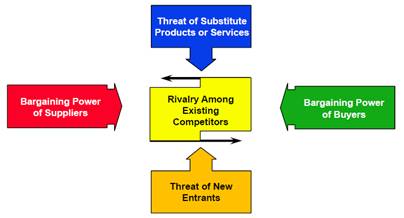

10. Determinants of Industry

Profitability

Industry Structure

1. Rivalry Among Existing

Competitors2. Threat of Substitute Products

or Services3. Bargaining Power of

Buyers4. Threat of New

Entrants5. Bargaining Power of

Suppliers

?

Part of the strategy agenda is to drive

improvements in industry structure

11. Analyzing Industry

Structure

Heavy Trucks

1. Rivalry Among Existing

Competitors

Heavy Price competition on standardized

models

2. Threat of Substitute

Products or Services

Railroads

Water transportation

3. Bargaining Power of

Buyers

Large fleets

Leasing companies

Small fleets and owner

operators

4. Threat of New

Entrants

Many truck producers are

assemblers

5. Bargaining Power of

Suppliers

Large independent suppliers of engines

and drive train componentsUnionized labor

12. Industry Structure and

Positioning

Paccar

• Focus on

owner-operators

• Compete on

differentiation

– Design trucks with special

features and amenities

– Customization and

build-to-order

– Design for low truck operating

costs

– Offer extensive roadside

assistance to truckers

• Command a premium

price

?

• Paccar"s positioning limits

the negative aspects of industry structure.

13. Industry Structure in Emerging

Economies

1. Rivalry Among Existing

Competitors

Monopoly concessions

SOEs with non-economic goals

Distortion of competition due to price

controls or regulationsProtection against imports

2. Threat of Substitute

Products or Services3. Bargaining Power of

Buyers

Weak consumer protection

lawsFragmented/small local

buyers

4. Threat of New

Entrants

High barriers to entry due to local

regulations and access to channelsProtection limits foreign

entry

5. Bargaining Power of

Suppliers

Protection of local

suppliersPowerful foreign suppliers of know-how,

licenses and equipment

– Industry competition in emerging

economies is often limited or distorted by government

policy or by the presence of entrenched monopolies

* Any industry can potentially

achieve high returns on investment

– Removal of government distortions

can lead to radical shifts in industry structure and

profitability

14. Strategic Positioning

Achieving Superior Relative

Performance

Differentiation (Higher Price) Lower

Cost

?

Competitive Advantage

?

Lower Cost

15. Competitive Advantage and the Value

Chain

Margin

Primary Activities

1. Inbound Logistics – (e.g.

Incoming Material Storage, Data Collection, Service, Customer

Access)2. Operations – (e.g. Assembly,

Component Fabrication, Branch Operations)3. Outbound Logistics – (e.g.

Order Processing, Warehousing, Report Preparation)4. Marketing & Sales – (e.g.

Sales Force, Promotion, Advertising, Proposal Writing, Web

site)5. After-Sales Service – (e.g.

Installation, Customer Support, Complaint Resolution,

Repair)

Support Activities

1. Firm Infrastructure – (e.g.

Financing, Planning, Investor Relations)2. Human Resource Management –

(e.g. Recruiting, Training, Compensation System)3. Technology Development – (e.g.

Product Design, Testing, Process Design, Material Research,

Market Research)4. Procurement – (e.g. Components,

Machinery, Advertising, Services)

* Value: What buyers are willing to

pay

All competitive advantage resides in

the value chain. Strategy is manifested in how activities in

the value chain are configured and linked together

16. Defining the Value

Chain

Homebuilding

Margin

Primary Activities

1. Land Acquisition &

Development – (Identify attractive markets, Secure land,

Procure entitlements and permits, Prepare site2. Construction – (Design,

Engineering, Schedule and manage construction

process)3. Marketing & Sales – (Lead

generation, Model home display, Sales force, Customer

selection of personalized options)4. Closing – (e.g. Customer

Financing, Contract, Title, Closing)5. After-Sales Service – (e.g.

Warranties, Customer Complaints)

Support Activities

5. Firm Infrastructure – (e.g.

Financing, Planning, Investor Relations)6. Human Resource Management –

(e.g. Recruiting, Training, Compensation System)7. Technology Development – (e.g.

Product Design, Testing, Process Design, Material Research,

Market Research)8. Procurement – (e.g. Components,

Machinery, Advertising, Services)

There are different ways of

configuring the value chain in the same

industry

17. Achieving Superior

Performance

Operational Effectiveness is Not

Strategy

OperationalEffectiveness ? Strategic

Positioning

OperationalEffectiveness

• Assimilating, attaining, and

extending best practices

?

Do the same thing better

Strategic Positioning

• Creating a unique and

sustainable competitive position

?

Do things differently to achieve a

different purpose

18. Reshaping Industry

Competition

Zero Sum Competition ? Positive Sum

Competition

Zero Sum Competition

• Compete head to

head

• One company"s gain requires

another company"s loss

• Competition often undermines

industry profitability

Positive Sum Competition

• Compete on

strategy

• More than one company can be

successful

• Competition expands the value

pool

19. What Is a Successful

Strategy?

• A unique value proposition

compared to other organizations

• A distinctive value chain

tailored to the value proposition

• Making clear tradeoffs, and choosing

what not to do

• Choices across the value chain that

fit together and reinforce each other

• Strategic continuity, with

continual improvement in realizing the strategy

Strategic

Positioning

IKEA, Sweden

Value Proposition

• Young, first time, or

price-sensitive buyers with design sophistication

• Stylish, space efficient and

compatible furniture lines and accessories at very low price

points.

Distinctive Activities

• Modular, ready-to-assemble, easy to

ship furniture designs

• In-house design of all

products

• Wide range of styles which are all

displayed in huge warehouse stores with large on-site

inventories

• Self-selection by the

customer

• Extensive customer information in

the form of catalogs, explanatory ticketing, do-it-yourself

videos, and assembly instructions

• IKEA designer names attached to

related products to inform coordinated purchases

• Suburban locations with large

parking lots

• Long hours of operation

• On-site, low-cost,

restaurants

• Child care provided in the

store

• Self-delivery by most

customers

21. Defining the Value

Proposition

?

• A novel value proposition often

expands the market

1. What

Customers?

• What end users?

• What channels?

2. Which Needs?

• Which products?

• Which features?

• Which services?

3. What Relative

Price?

• Premium? Parity?

Discount?

Strategic

Positioning

PACCAR

Value Proposition

• Highly customized trucks targeted at

owneroperators with superior amenities but low cost of use and

extensive customer support

• Command a 10% premium

price

Distinctive Activities

• Customized features and amenities

geared toward owner-operators (e.g., luxurious sleeper cabins,

plush leather seats, noise-insulated cabins, sleek exterior

styling, etc.)

• Products designed for durability and

resale value

• Industry leader in fuel efficiency

and emissions reduction, including medium duty hybrids

• Offer truck financing, leasing and

insurance services

• Provide diagnostic services for

customers (e.g., fuel efficiency, remote service

analysis)

• Flexible manufacturing system

configured for customization

• Built to order, not to

stock

• Extensive dealer network (1,800

locations) to provide extensive customer contact and aftermarket

support

• Extensive roadside assistance

network

• 24-hour parts distribution system

providing rapid

Service

23. Making Strategic

Tradeoffs

• Tradeoffs occur when strategic

positions are incompatible

Sources of Tradeoffs

– Incompatible product or service

features / attributes

– Differences in the value chain

required to best deliver the chosen value proposition

– Inconsistencies in image or

reputation across value propositions

– Organizational complexity of

delivering different value propositions

?

• Tradeoffs create the need for

choice

• Tradeoffs make a strategy

sustainable against imitation by established

rivals

• An essential part of strategy is

choosing what not to do

24. Strategic Tradeoffs

IKEA, Sweden

IKEA

Product

• Low-priced, modular,

ready-to-assemble

designs

• No custom options

• Furniture design driven by

cost,

manufacturing simplicity, and

style

Value Chain

• Centralized, in-house design of all

products

• All styles on display in huge

warehouse stores

• Large on-site inventories

• Limited sales help, but extensive

customer

information

• Long hours of operation

Typical Furniture

Retailer

Product

• Higher priced, fully assembled

products

• Customization of fabrics, colors,

finishes,

and sizes

• Design driven by image, materials,

varieties

Value Chain

• Source some or all lines from

outside

suppliers

• Medium sized showrooms with

limited

portion of available models on

display

• Limited inventories / order with

lead time

• Extensive sales

assistance

• Traditional retail hours

25. Typical Thinking About the Sources

of Competitive Advantage

• "Key" Success

Factors

• "Core"

Competencies

• "Critical"

Resources

?

• Competitive advantage is usually

seen as concentrated in a few parts

of the value chain

26. Mutually Reinforcing Activity

Choices

IKEA

1. Complete line of furniture

and accessories to furnish home (MAIN)

Designer identification of compatible

lines

All items on display and instock

Year-round stocking to even out

production

2. Customer self delivery and

assembly

All items on display and instock

Instructions and support for customer

assembly

Suburban locations with ample

parking

Ease of transport and assembly

"Knock-down" kit packaging

Suburban locations with ample

parking

Very large stores

3. Modular, scalable furniture

designs

Designer identification of compatible

lines

Ease of transport and assembly

"Knock-down" kit packaging

In-house design focused on cost of

manufacturing

High variety, but ease of

manufacturing

4. Low manufacturing and

logistical costs

In-house design focused on cost of

manufacturing

High variety, but ease of

manufacturing

100 percent sourcing from long-term

suppliers

Year-round stocking to even out

production

5. Self-selection by

customer

All items on display and instock

Explanatory catalogs, informative displays

and labels

High traffic store layout

27. Strategic Continuity

• Continuity of strategy is

essential to creating and sustaining competitive

advantage

– e.g., understanding the

strategy

– building truly unique skills and

assets related to the strategy

– establishing a clear identity with

customers, channels, and other outside entities

– strengthening fit across the value

chain

• "Reinvention" and frequent

shifts in direction are costly and confuse the customer, the

industry, and the organization

?

Implications

• Maintain continuity in the value

proposition

• Continuously improve ways to

realize the value proposition

– Strategic continuity and continuous

change should occur simultaneously

• Continuity of strategy allows

faster improvement.

28. Finding a Unique Strategic

Position

• Finding a novel value

proposition

– Creative segmentation

– Understanding tradeoffs

29. Reinventing the Value

Chain

Enterprise Rent-A-Car

Value Proposition

• Home-city replacement cars to

drivers whose cars

are being repaired or who need an extra

vehicle, at

low rates (30% below airport

rates)

Distinctive Activities

• Numerous, small, inexpensive

offices, including

on-premises offices at major

accounts

• Open during daylight

hours

• Delivers cars to customers" homes or

rental sites,

or customers to cars

• Acquire new and older cars, favoring

soon-to-be

discontinued older models

• Keep cars six months longer than

other major

rental companies

• In-house reservations

• Grassroots marketing with limited

television

• Cultivate strong relationships with

auto

dealerships, body shops, and insurance

adjusters

• Hire extroverted college graduates

to encourage

community interaction and customer

service

• Employ a highly sophisticated

computer network to

track its fleet

30. Finding a Unique Strategic

Position

• Finding a novel value

proposition

– Creative segmentation

– Understanding tradeoffs

• Reinventing the value

chain

31. Strategic Positioning

Nespresso

Value Proposition

• Uniquely high quality, easy to

prepare single-serve

espresso coffee at a premium

price

• Demanding, convenience-sensitive,

affluent

consumers, and offices

Distinctive Activities

• Extra-high quality ground coffee in

16+ varieties

• Individually proportioned capsules

for freshness

and ease of use

• Tailored espresso machines

manufactured by

high-end machine vendors

• Capsules sold only online or through

about 200

coffee boutique shops in major cities, not

in mass

market food channels

• Nespresso Club to achieve high

levels of

communication with customers

• Focused image-oriented media

advertising

32. Finding a Unique Strategic

Position

• Finding a novel value

proposition

– Creative segmentation

– Understanding tradeoffs

• Reinventing the value

chain

• Anticipating industry

dynamics

• Successful strategies involve a core

strategic insight that is

improved and expanded over

time

33. Growing Strategically

1. Make the strategy even more

distinctive

– Introduce new technologies, features,

products or services that leverage other

distinctive activities within the

value chain

– Create a social dimension to the

value proposition and value chain

2. Deepen the strategic position

(rather than broaden it)

– Raise the penetration of chosen

customers / needs

3. Expand geographically to tap new

regions or countries using the same positioning

– Aggressively reposition foreign

acquisitions around the company"s strategy

4. Expand the market for what the

company can uniquely deliver

– Find other customers and segments that

value the strategy

?

• It is an illusion that growth

(and especially profitability) are easier to achieve in untapped

or growth segments

• It is difficult, and often

dangerous, to try to grow faster than the underlying

market for an extended period.

• Industry leaders should concentrate

as much, or more, on growing the category as on growing

share

• In many cases, shareholders are

actually best served by earning a high return and returning

capital, especially via dividends

Competing

Regionally and Globally

• Selling in many

nations

?

• Locating activities in

different nations

?

• Coordinating a regional or

global network

Margin

Firm Infrastructure

Human Resource Management

Technology Development

Procurement

??

Inbound Logistics

Operations

Outbound Logistics

Marketing And Sales

After Sales Service

35. Internationalization

Strategic Principles

• Internationalize in ways that

reinforce the company"s strategy

• Internationalize first in product

lines or customer segments where the company has the most

unique advantages

• Prioritize markets to

enter

– Similar needs and segments

– Expatriates

• Gain direct access to foreign

markets as soon as practical rather than relying solely on

intermediaries

• Use alliances selectively as

transitional strategies

– Ensure that alliances do not block

the company"s ability to gain competitive advantage and build its

own capabilities

• Locate and integrate manufacturing

and other activities from a regional

perspective

36. Why Do Good Managers Choose Bad

Strategies?

Flawed Management

Concepts

• Misunderstanding of strategy

principles

• Poor industry definition

obscures the arena in which competitive advantage is actually

determined

Pressures for Industry

Convergence

• Industry conventional wisdom

leads all companies to follow common practices

• Customers ask for

incompatible features or request new products or services that do

not fit the strategy

• Labor agreements or

regulations constrain price, product, service or process

alternatives

37. Why Do Good Managers Choose Bad

Strategies?

Management Practices

• Inappropriate cost allocation

leads to too many products, services, or customers

• Over-outsourcing makes

products and activities homogenous and less

distinctive

Organizational Incentives

• Inappropriate goals and

performance metrics bias strategy choices

– Size over profitability

– Short time horizon

• A desire for consensus blurs

strategic tradeoffs

• Rapid turnover of leadership

undermines strategy in favor of short-term performance

38. Why Do Good Managers Choose Bad

Strategies?

Capital Markets

• Search for short-term

"surprises" in earnings or revenue

• Use of industry-wide metrics

are misaligned with true economic value and drive strategic

convergence

• Encourage companies to

emulate currently "successful" peers

• Strong pressure to grow

faster than the industry

• Bias in favor of "doing

deals" (M&A)

39. Multiple Levels of Strategy Drive

Competitive Advantage

Competitive or Business

Strategy

• How to compete in each distinct

business or

Industry

?

Corporate Strategy

• Advantaged positions in

attractive industries

• Capturing synergies across

business units

40. Premises of Corporate

Diversification

• Overall corporate size per se

does not create economic value

• Competition occurs at the level of

individual businesses

• Being part of a diversified company

involves inevitable costs for business units

• Shareholders can diversify

directly at lower cost

• Successful corporate strategy must

produce a clear and offsetting benefit to the competitive

advantage of business units

– That are not possible with alternative

governance structures (e.g. alliances)

?

• The central issue in corporate

strategy is how the corporation adds competitive value to

its businesses.

41. Diversification in Emerging

Economies

Typical Business Groups

Financial Services

Sugar

Airline

Hotel

Real Estate

Services

Computer

Wholesaler

Grocery

Stores

Fast Food

Franchises

Industrial

Parts

Imports/

Distribution

Food

Processing

TobaccoTextiles

Car Dealership

42. Corporate Strategy

• Shared characters

• Shared brand

• Shared family

values

• Cross-promotions

MAIN DISNEY COMPANYS

1. Theme Parks

2. Family Motion

Pictures3. Consumer Products

4. Television

Programming5. Disney Records

6. Youth Books and Educational

Materials7. Traveling Shows

43. Creating Corporate Value

Added

• Harnessing fit across the value

chains of business units

– Sharing activities across business

units

– Leveraging proprietary knowledge and

skills across units

• Sharing corporate overhead is not

enough

44. The Process of Developing a

Strategy

• Strategy should be developed and

periodically reviewed in a formal process rather than

being left to occur spontaneously

– The process need not be highly

structured

• Business unit strategy development

is best done in a multifunctional team including the

general manager and heads of important

functions

– The strategic planning department serves

as staff

– The strategy team is relatively

small

– The team needs to work together

not separately

• Strategy development is not a

fully democratic process. The leader must ultimately

decide

• The strategy must be

communicated widely, both externally and

internally

• Enhancements to the strategy should

be discussed and implemented continuously

• A strategy review, which examines

the assumptions on which the strategy is based, should

take place formally at least once per year

45. Communicating

Strategy

• Strategy involves everyone in

an organization, not just top management

• The benefits of strategy are

greatest when it is communicated widely in the

organization

• Communicating strategy requires a

simple and vivid way of describing the essence of the

company"s unique position

– Symbols of the strategy are invaluable

tools

– Repetition

• The basic strategy and value

proposition must also be communicated to customers,

channels, suppliers, and financial markets

– What about confidentiality?

• Leaders should not assume

that subordinates understand the strategy, or that they

agree with it

– Help each organizational unit

translate the strategy into implications for its own

mandate

• Individuals who do not ultimately

accept the strategy cannot have an

ongoing role in the

company

46. The Role of Leaders in

Strategy

Commitment to strategy is tested every

day

• Drive operational

improvement, but clearly distinguish it from

strategy

• Lead the process of choosing

the company"s unique position

– The CEO is the chief

strategist

– The choice of strategy cannot be

entirely democratic

• Communicate the strategy

relentlessly to all constituencies

– Harness the moral purpose of

strategy

• Maintain discipline around

the strategy, in the face of many distractions.

• Decide which industry

changes, technologies, and customer needs to respond to, and

how

the response can be tailored to the

company"s strategy

• Measure progress against the

strategy using metrics that capture the implications of

the

strategy for serving customers and

performing particular activities

• Sell the strategy and how

to evaluate progress against the strategy to the financial

markets

?

"Commitment to strategy is tested every

day"

The Role of

Business in Society: Creating Shared Value

Professor Michael E. Porter

Harvard Business School

Guayaquil, Ecuador

October 25, 2011

Página siguiente  |