we simplify still further

to write

(3)

8

W =?u(c)e-dtdt

0

We assume here that there is just one individual at each point in time (or a group of identical

individuals) and that the utility or valuation function is unchanging over time. We introduce

population and its change later in the discussion.

In Chapter 2 we argued, following distinguished economists from Frank Ramsey in the 1920s

to Amartya Sen and Robert Solow more recently, the only sound ethical basis for placing less

value on the utility (as opposed to consumption) of future generations was the uncertainty

over whether or not the world will exist, or whether those generations will all be present. Thus

we should interpret the factor e-dt in (3) as the probability that the world exists at that time. In

fact this is exactly the probability of survival that would apply if the destruction of the world

was the first event in a Poisson process with parameter d (i.e. the probability of an event

occurring in a small time interval ?t is d?t). Of course, there are other possible stochastic

processes that could be used to model this probability of survival, in which case the

probability would take a different form. The probability reduces at rate d. With or without the

stochastic interpretation here, d is sometimes called ‘the pure time discount rate.’ We discuss

possible parameter values below.

The key concept for discounting is the marginal valuation of an extra unit of consumption at

time t, or discount factor, which we denote by ?. We can normalise utility so that the value of ?

at time 0 along the path under consideration is l. We are considering a project that perturbs

consumption over time around this particular path. Then, following the basic criterion,

equation 2, for marginal changes we have to sum the net incremental benefits accruing at

each point in time, weighting those accruing at time t by ?. Thus, from the basic marginal

criteria (2), in the special case (3), we accept the project if,

(4)

8

?W =???cdt > 0

0

where ? and c are each evaluated at time t, ?c is the perturbation to consumption at time t

arising from the project and ? is the marginal utility of consumption where

(5)

? =u'(c)e-dt

If, for example, we have to invest to gain benefits then ?c will be negative for early time

periods and positive later.

STERN REVIEW: The Economics of Climate Change

45

? =? +d

PART I: Climate Change – Our Approach

The rate of fall of the discount factor is the discount rate, which we denote by ?. These

definitions and the special form of ? as in (5) are in the context of the very strong

simplifications used. Under uncertainty or with many goods or with many individuals, there will

be a number of relevant concepts of discount factors and discount rates.

The discount factors and rates depend on the numeraire that is chosen for the calculation.

Here it is consumption and we examine how the present value of a unit of consumption

changes over time. If there are many goods, households, or uses of revenue we must be

explicit about choice of numeraire. There will, in principle, be different discount factors and

rates associated with different choices of numeraire – see below.

Even in this very special case, there is no reason to assume the discount rate is constant. On

the contrary, it will depend on the underlying pattern of consumption for the path being

examined; remember that ? is essentially the discounted marginal utility of consumption along

the path.

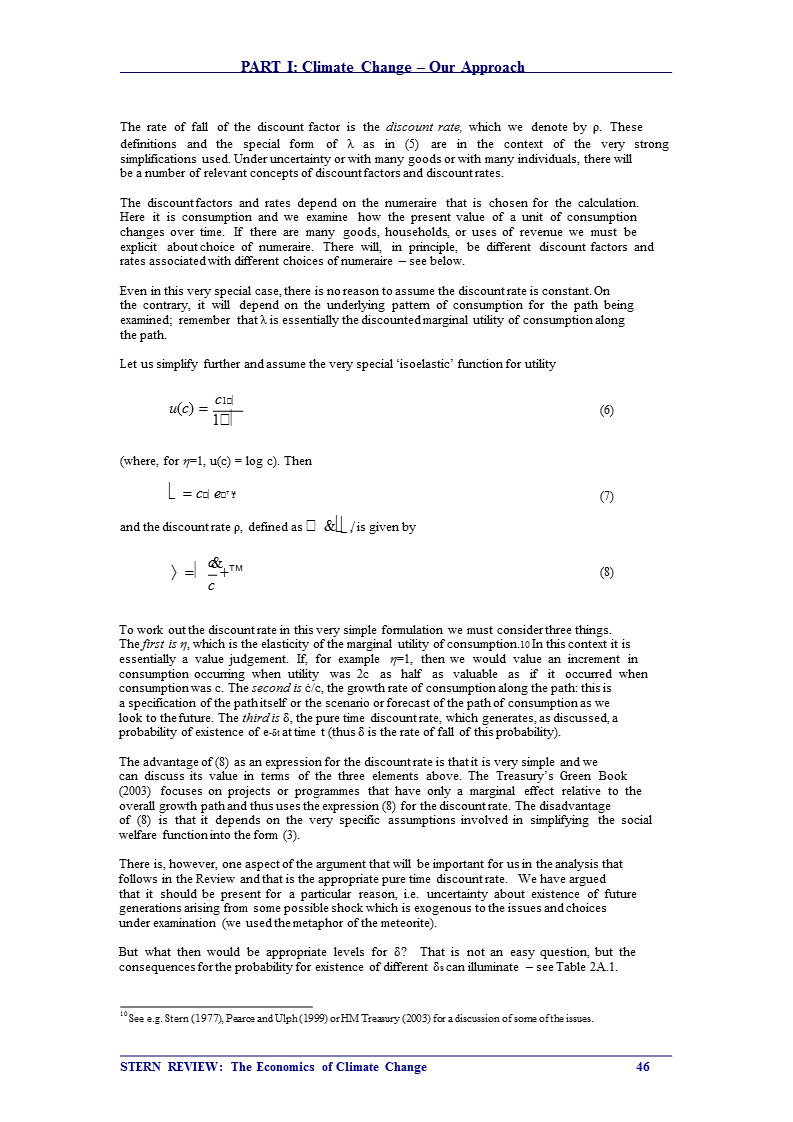

Let us simplify further and assume the very special ‘isoelastic’ function for utility

c1-?

1-?

u(c) =

(6)

?/

c

(where, for ?=1, u(c) = log c). Then

? = c-?e-dt

and the discount rate ?, defined as – &? , is given by

&

c

(7)

(8)

To work out the discount rate in this very simple formulation we must consider three things.

The first is ?, which is the elasticity of the marginal utility of consumption.10 In this context it is

essentially a value judgement. If, for example ?=1, then we would value an increment in

consumption occurring when utility was 2c as half as valuable as if it occurred when

consumption was c. The second is c/c, the growth rate of consumption along the path: this is

a specification of the path itself or the scenario or forecast of the path of consumption as we

look to the future. The third is d, the pure time discount rate, which generates, as discussed, a

probability of existence of e-dt at time t (thus d is the rate of fall of this probability).

The advantage of (8) as an expression for the discount rate is that it is very simple and we

can discuss its value in terms of the three elements above. The Treasury’s Green Book

(2003) focuses on projects or programmes that have only a marginal effect relative to the

overall growth path and thus uses the expression (8) for the discount rate. The disadvantage

of (8) is that it depends on the very specific assumptions involved in simplifying the social

welfare function into the form (3).

There is, however, one aspect of the argument that will be important for us in the analysis that

follows in the Review and that is the appropriate pure time discount rate. We have argued

that it should be present for a particular reason, i.e. uncertainty about existence of future

generations arising from some possible shock which is exogenous to the issues and choices

under examination (we used the metaphor of the meteorite).

But what then would be appropriate levels for d? That is not an easy question, but the

consequences for the probability for existence of different ds can illuminate – see Table 2A.1.

10

See e.g. Stern (1977), Pearce and Ulph (1999) or HM Treasury (2003) for a discussion of some of the issues.

STERN REVIEW: The Economics of Climate Change

46

PART I: Climate Change – Our Approach

For d=0.1 per cent, there is an almost 10% chance of extinction by the end of a century. That

itself seems high – indeed if this were true, and had been true in the past, it would be

remarkable that the human race had lasted this long. Nevertheless, that is the case we shall

focus on later in the Review, arguing that there is a weak case for still higher levels.11 Using

d=1.5 per cent, for example, i.e. 0.015, the probability of the human race being extinct by the

end of a century would be as high as 78%, indeed there would be a probability of extinction in

the next decade of 14%. That seems implausibly, indeed unacceptably high as a description

of the chances of extinction.

However, we should examine other interpretations of ‘extinction’. We have expressed survival

or extinction of the human race as either one or the other and have used the metaphor of the

devastating meteorite. There are also possibilities of partial extinction by some exogenous or

man-made force that has little to do with climate change.

Nuclear war would be one

possibility or a devastating outbreak of some disease that ‘took out’ a significant fraction of

the world’s population.

In the context of project uncertainty, rather different issues arise. Individual projects can and

do collapse for various reasons and in modelling this type of process we might indeed

consider values of d rather higher than shown in this table. This type of issue is relevant for

the assessment of public sector projects, see, for example, HM Treasury (2003), the Green

Book.

A different perspective on the pure time preference rate comes from Arrow (1995). He argues

that one problem with the absence of pure time discounting is that it gives an implausibly high

optimum saving rate using the utility functions as described above, in a particular model

where output is proportional to capital. If d=0 then one can show that the optimum savings

rate in such a model12 is 1/?; for ? between 1 and 1.5 this looks very high. From a discussion

of ‘plausible’ saving rates he suggests a d of 1%. The problem with Arrow’s argument is, first,

that there are other aspects influencing optimum saving in possible models that could lower

the optimum saving rate, and second, that his way of ‘solving’ the ‘over-saving’ complication

is very ad hoc. Thus the argument is not convincing.

Arrow does in his article draw the very important distinction between the ‘prescriptive’ and the

‘descriptive’ approach to judgements of how to ‘weigh the welfare’ of future generations – a

distinction due to Nordhaus (see Samuelson and Nordhaus, 2005). He, like the authors

described in Chapter 2 on this issue, is very clear that this should be seen as a prescriptive or

ethical issue rather than one which depends on the revealed preference of individuals in

allocating their own consumption and wealth (the descriptive approach). The allocation an

individual makes in her own lifetime may well reflect the possibility of her death and the

probability that she will survive a hundred years may indeed be very small.

But this

intertemporal allocation by the individual has only limited relevance for the long-run ethical

question associated with climate change.

11

12

See also Hepburn (2006).

This uses the optimality condition that the discount rate (as in (8)) should be equal to the marginal product of

capital.

STERN REVIEW: The Economics of Climate Change

47

?N u(C /N )e d

PART I: Climate Change – Our Approach

There is nevertheless an interesting question here of combining short-term and long-term

discounting. If a project’s costs and benefits affect only this generation then it is reasonable

to argue that the revealed relative valuations across periods has strong relevance (as it does

across goods). On the other hand, as we have emphasised allocation across generations

and centuries is an ethical issue for which the arguments for low pure time discount rates are

strong.

Further, we should emphasise that using a low d does not imply a low discount rate. From (8)

.

we see, e.g., that if ? were, say, 1.5, and c/c were 2.5% the discount rate would be, for d= 0,

3.75%. Growing consumption is a reason for discounting. Similarly if consumption were

falling the discount rate would negative.

As the table shows the issue of pure time discounting is important. If the ethical judgement

were that future generations count very little regardless of their consumption level

then investments with mainly long-run pay-offs would not be favoured. In other words,

if you care little about future generations you will care little about climate change. As

we have argued, that is not a position which has much foundation in ethics and which

many would find unacceptable.

Beyond the very simple case

We examine in summary form the key simplifying assumptions associated with the

formulation giving equations (3) and (8) above, and ask how the form and time pattern of the

various discount factors and discount rates might change when these assumptions are

relaxed.

Case 1 Changing population

With population N at time t and total consumption of C, we may write the social welfare

function to generalise (3) as

(9)

8

W =? Nu(C / N)e-dtdt

0

In words, we add, over time, the utility of consumption per head times the number of people

with that consumption: i.e. we simply add across people in this generation, just as in (3) we

added across time; we abstract here from inequality within the generation (see below). Then

the social marginal utility of an increment in total consumption at time t is again given by (5)

where c is now C/N consumption per head. Thus the expression (8) for the discount rate is

unchanged. We should emphasise here that expression (9) is the appropriate form for the

welfare function where population is exogenous. In other words we know that there will be N

people at time t. Where population is endogenous some difficult ethical issues arise – see, for

example, Dasgupta (2001) and Broome (2004, 2005).

Case 2 Inequality within generations

Suppose group i has consumption Ci and population Ni. We write the utility of consumption at

time t as

i

– t

i i i

(10)

and integrate this over time: in the same spirit as for (9), we are adding utility across sub-

groups in this generation. Then we have, replacing (5), where ci is consumption per head for

group i,

(11)

?i = u'(ci)e-dt

STERN REVIEW: The Economics of Climate Change

48

PART I: Climate Change – Our Approach

as the discount factor for weighting increments of consumption to group i. Note that in

principle the probability of extinction could vary across groups, thus making di dependent on i.

An increment in aggregate consumption can be evaluated only if we specify how it is

distributed. Let us assume a unit increment is distributed across groups in proportions ai.

Then

(12)

? =?aiu'(ci)e-dt

i

For some cases ai may depend on ci, for example, if the increment were distributed just as

total consumption, so that ai = Ci/C where C is total consumption. In this case, the direction of

movement of the discount rate will depend on the form of the utility function. For example, in

this last case, if ?=1, the discount rate would be unaffected by changing inequality.

If ai = 1/N this is essentially ‘expected utility’ for a ‘utility function’ given by u'( ). Hence the

Atkinson theorem (1970) tells us that if {ci} becomes more unequal13 then ? will rise and the

discount rate will fall if u' is convex (and vice versa if it is concave). The convexity of u' ( ) is

essentially the condition that the third derivative of u is positive: all the isoelastic utility

functions considered here satisfy this condition14.

For ai ‘tilted’ towards the bottom end of the income distribution, the rise is reinforced.

Conversely, it is muted or reversed if ai is ‘tilted’ towards the top end of the income

distribution. For example, where ai = 1 for the poorest subset of households, then ? will rise

where rising inequality makes the poorest worse off. But where aN = 1 for the richest

household, ? will fall if rising income inequality makes the richest better off. Note that in the

above specification the contribution of individual i to overall social welfare depends only on

the consumption of that individual. Thus we are assuming away consumption externalities

such as envy.

Case 3 Uncertainty over the growth path

We cannot forecast, for a given set of policies, future growth with certainty. In this case, we

have to replace the right-hand side of (5) in the expression for ? by its expectation. This then

gives us an expression similar to (12), where we can now interpret ai as the probability of

having consumption in period t, denoted as pi in equation (13). We would expect uncertainty

to grow over time in the sense that the dispersion would increase. Under the same

assumptions, i.e. convexity of u', as for the increasing inequality case, this increasing

dispersion would reduce the discount rate over time. Increased uncertainty (see Rothschild

and Stiglitz, 1976 and also Gollier, 2001) increases ? if u' is convex since ? is essentially

expected utility with u' as the utility function.

(13)

? =? piu'(ci)e-dt

i

Figure 2A.1 shows a simple example of how the discount factor falls as consumption

increases over time, when the utility function takes the simple form given in equation (6). The

chart plots the discount factor along a range of growth paths for consumption; along each

path, the growth rate of consumption is constant, ranging from 0 per cent to 6 per cent per

year. The value of d is taken to be 0.1 per cent and of ? 1.05. The paths with the lowest

growth rates of consumption are the ones towards the top of the chart, along which the

discount factor declines at the slowest rate. Figure 2A.2 shows the average discount rate over

time corresponding to the discount factor given by equation (13), assuming that all the paths

13

This property can be defined via distribution functions and Lorenz curves. It is also called second-order stochastic

domination or Lorenz-dominance: see e.g. Gollier (2001), Atkinson (1970) and Rothschild and Stiglitz (1970).

14

concave utility function.

STERN REVIEW: The Economics of Climate Change

49

Discount rate

10

13

16

19

22

25

28

31

34

37

40

43

46

49

52

55

58

61

64

67

70

73

76

79

82

85

88

91

94

97

1

4

7

PART I: Climate Change – Our Approach

are equally likely. This falls over time. For further discussion of declining discount rates, see

Hepburn (2006).

Figure 2A.1

Paths for the discount factor

1.2

1

0.8

0.6

0.4

0.2

0

T i me

Figure 2A.2

Average discount rate

0.035

0.03

0.025

0.02

0.015

0.01

0.005

0

Time

Further complications

The above treatment has kept things very simple and focused on a case with one

consumption good and one type of consumer, and says little about markets.

Where there are many goods, and different types of household and market imperfections we

have to go back to the basic marginal criterion specified in (2) and evaluate ?uh for each

STERN REVIEW: The Economics of Climate Change

50

PART I: Climate Change – Our Approach

household taking into account these complications: for a discussion, see Drèze and Stern

(1990). There will generally be a different discount rate for each good and for each consumer.

One can, however, work in terms of a discount rate for aggregate (shadow) public revenue.

A case of particular relevance in this context would be where utility depended on both current

consumption and the natural environment. Then it is highly likely that the relative ‘price’ of

consumption and the environment (in terms of willingness-to-pay) will change over time. The

changing price should be explicit and the discount rate used will differ according to whether

consumption or the environment is numeraire (see below on Arrow (1966)).

Growing benefits in a growing economy: convergence of integrals.

We examine the special case (4) of the basic marginal criteria (2). The convergence of the

integral requires ? to fall faster than the net benefits ?c are rising. Without convergence, it will

appear from (4) that the project has infinite value. Suppose consumption grows at rate g and

the net benefits at g. From (8) and (4) we have that for convergence we need, in the limit into

the distant future,

ˆ

?g +d > g

(14)

If, for example, g and g are the same (benefits are proportional to consumption) then for

convergence we need, in the limit,

d > (1-?)g

(15)

Where ?=1 and d>0, this will be satisfied. But for ?

Página anterior Página anterior |   Volver al principio del trabajo Volver al principio del trabajo | Página siguiente  |